4 min read

Crude Oil Hedging in An Uncertain Environment - $30 or $200

WTI has traded in a volatile range lately, as have Brent and all other grades of crude oil. The prompt WTI crude oil contract lost more than 8% of...

2 min read

Mercatus Energy : Jun 23,2012

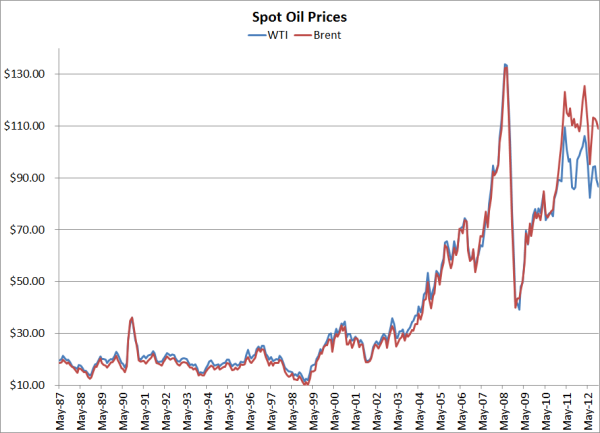

Heading into the weekend, it appears that Brent crude oil may settle the day at below $90/BBL for the first time since December of 2010, while WTI continues to march towards $75/BBL. Likewise, heating oil is down $0.80/gallon since it's late February peak, gasoil has declined just shy of $250/MT since March and gasoline is down nearly $0.90/gallon over the past few months as well.

What's driving prices lower? The simple answer is that commodities prices as a whole are in a state of decline. The S&P GSCI (Standard & Poors - Goldman Sachs Commodity Index) is now down about 13.5% year to date. Take Brent crude oil as an example. Since peaking in early March at $128.40/BBL, Brent is down 30%, now trading near $90/BBL. To look at it from another perspective, as of May 25th, August '12 Brent futures were trading at $106.36/BBL while August '13 Brent futures were trading at $102.21/BBL, which indicated that near term demand was perceived to be much stronger than longer-dated demand. As of today, we're looking at the opposite as August '12 Brent futures are trading near $90/BBL while August '13 Brent futures are trading in the $91.50/BBL range. In trading jargon, in just a few weeks, the shape of the forward curve has shifted from a state of backwardation to that of a contango, meaning that a structural change is underway.

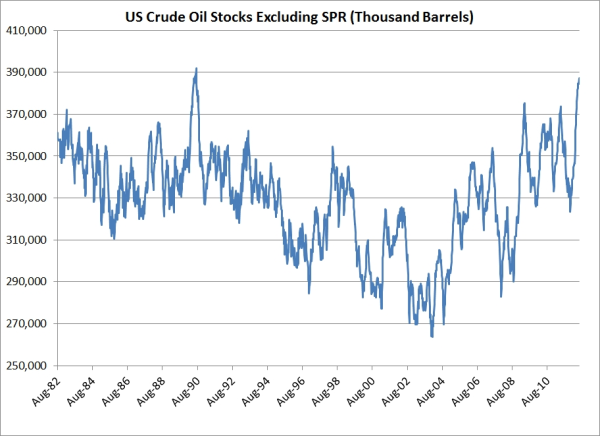

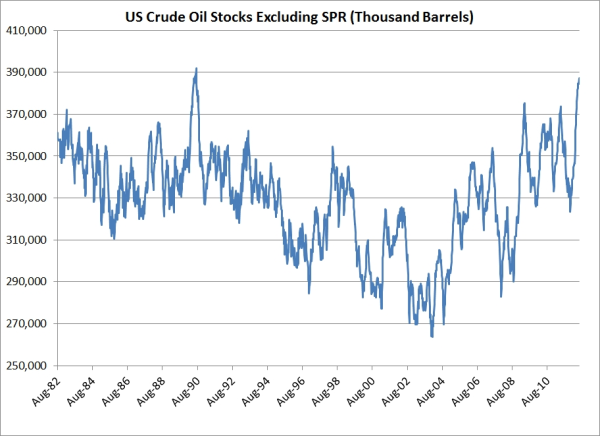

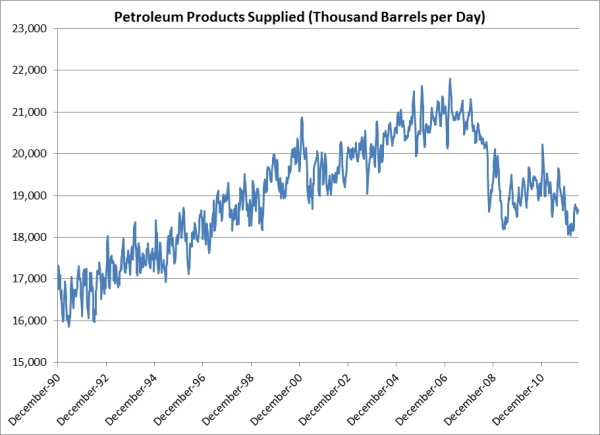

The fundamental data from the EIA paints a similar picture. US crude oil inventories currently sit at the second highest level on record. On the other hand, implied demand (as reported by the EIA as products supplied), despite a modest increase since the beginning of the year, is rather weak relative to recent history, having declined by 3.13MM barrels per day since peaking in February of 2007.

So, what does of this all mean mean for those who have hedged or are thinking about hedging their oil or fuel risk? As we have said many times before, it all comes down to your needs and risk tolerance, which should begin with establishing a risk management policy and plan, if you haven't already done so. For the vast majority of fuel consumers, hedging at the current price levels will allow you hedge your fuel costs at a price which is well below budget. On the producer side, hedging WTI at $80/BBL or Brent at $90/BBL may not seem all that attractive given where oil was trading as recent as a month ago but, there's nothing to say that prices won't continue to decline, at least in the near term.

As we've said many times over the years, if you're not hedging, you're speculating. If you're comfortable with that, keep calm and carry on...

4 min read

WTI has traded in a volatile range lately, as have Brent and all other grades of crude oil. The prompt WTI crude oil contract lost more than 8% of...

2 min read

In early December the EIA announced that beginning with its 2013 Annual Energy Outlook, which will be published in the spring, the agency is going to...

3 min read

Last December, in a post titled Sovereign State Oil Hedging On The Rise, we highlighted the hedging initiatives of several sovereign oil and gas...