2 min read

Special Update - Crude Oil, Refined Products & Natural Gas

We generally don't provide public "market commentary" but given the events of the past week and their impact on the energy markets, we thought we...

As more and more companies are looking at hedging their exposure to volatile energy prices, many for the first time, we thought it would be prudent to revisit our recommendations regarding the development, or updating, of an energy hedging policy. So, how does one go about developing an energy fuel hedging policy (also often called an energy or fuel price risk management policy)?

You (ideally the board of directors or executive management team) need to begin by defining the purpose(s) or goal(s) of your policy. As an example, the purpose of an airline's fuel risk management policy might include one or more of the following:

Next you will want to define the who, what, how, why and when of the policy.

Who is going to be responsible for ensuring that the company adheres to policy?

Who is responsible for developing, implementing and managing the fuel hedging policy and accompanying strategies and procedures? A hedge committee, chief financial officer, treasury department, etc.?

Who is responsible for selecting appropriate counterparties and/or futures commission merchants and what criteria will be used to evaluate them? Who and by what means will counter-party credit exposure be analyzed and monitored? What happens when a counterparty is no longer compliant per your risk policy?

Who is responsible for executing transactions?

What resources (manpower, risk management systems, commodity market data, etc.) will said individuals and/or teams need to properly carry out their responsibilities?

What checks and balances need to exist?

What type of transactions will be permitted? Physical forwards, futures, swaps, options?

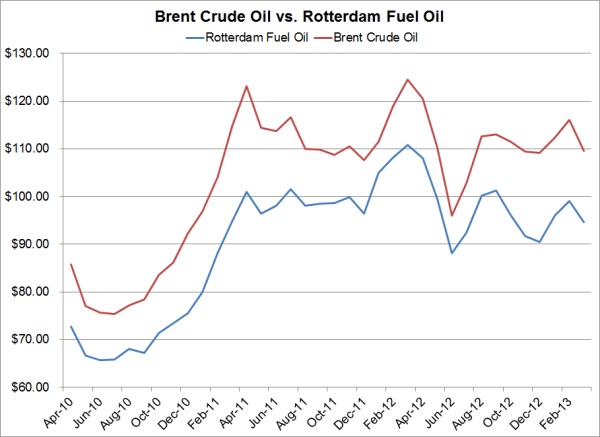

What indices will be permitted i.e. WTI crude oil, Brent crude oil, CME/NYMEX ULSD, ICE gasoil, Gulf Coast ULSD, NW Europe fuel oil, Singapore jet fuel, etc.?

What are the minimum and maximum volumes, or percentages of forecasted volumes, which can be hedged in any given time frame?

What is the maximum financial exposure (gross and net) that the company is willing and able to tolerate?

When and why will transactions be executed?

When and how will existing positions be reviewed to ensure that they are still appropriate given the company's risk tolerance, hedging policy and current market conditions?

When and how will the various risks (market, credit, operational, regulatory) be measured and by whom?

Who is responsible for position and risk reporting? What are they to report, how frequently and to whom?

Should the company ever be allowed to operate outside the scope of the policy? If yes, who has the authority to make this determination?

How often should the policy be reviewed and by whom?

Clearly there are a lot of issues to be explored when developing a fuel hedging policy but if you can honestly and accurately answer all these questions you will be well on your way.

If you need assistance with the development or updating of your policy, please don't hesitate to contact us, we have worked with numerous clients to help them develop or update their energy and fuel hedging and risk management policies.

2 min read

We generally don't provide public "market commentary" but given the events of the past week and their impact on the energy markets, we thought we...

2 min read

We've recently been engaged by a couple new clients which are going to be hedging their exposure to energy commodity prices for the first time in...

2 min read

Over the past couple years we have addressed various aspects of both basis risk and costless collars however, until now, we have not addressed the...