2 min read

Opportunistic Diesel Fuel Hedging Strategies as Oil Markets Collapse

As crude oil and refined products continue to decline, we're hearing from many commercial and industrial fuel consumers who are looking for...

Given the recent decline in crude oil prices, and in turn, diesel fuel prices, we thought it would be beneficial to address various diesel fuel hedging strategies available to diesel fuel consumers (end-users). Today we’re going to cover the most common instrument used to hedge diesel fuel price risk, swaps, but in future posts we'll also address several, additional diesel fuel hedging strategies such as call options, costless collars, etc.

What is a diesel fuel swap? In essence, it is an agreement whereby the buyer and seller of the swap exchange their floating price exposure for fixed price exposure and vice versa. The product is called a "swap" because the buyers and sellers of the swap are “swapping” their cash flow exposures. Diesel fuel end-users can utilize diesel fuel swaps in order to lock in their diesel fuel costs while refiners and fuel marketers can utilize diesel fuel swaps in order to lock in their profit margins.

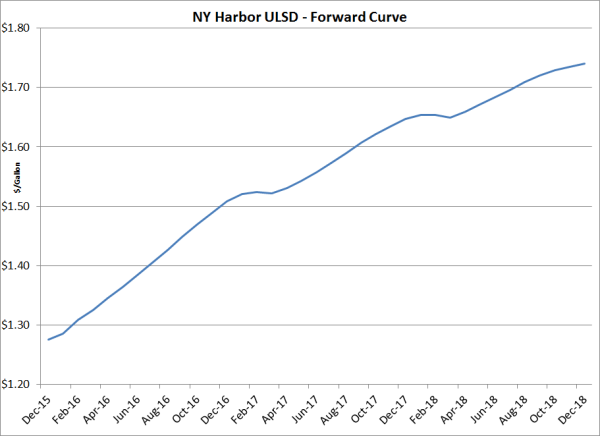

As an example of how a fleet can utilize a diesel fuel swap to hedge its exposure to fuel price volatility, let's assume that you manage a fleet which consumes 126,000 gallons (equivalent to 3,000 barrels) of ULSD (ultra- low sulfur diesel) fuel per month. Let's further assume that you are looking to hedge (fix the price) 100% of the ULSD that you that will consume in March. In order to hedge these gallons, you could purchase a March ULSD swap, for 126,000 gallons (3,000 barrels), from your counter-party (often a financial institution or major oil company). If you had purchased this swap as of yesterday, the price would have been (approximately) $1.3251/gallon.

So, now that you have purchased the swap, let's take a look at how the swap performs if the average price of ULSD during the month of March averages both lower and higher than the price of your swap, $1.3251/gallon.

If ULSD prices decrease by 25 cents per gallon, the average price for ULSD (as published by CME Group, Argus or Platts, respectively) for each business day in March, would be $1.0751/gallon. Since you purchased the swap for $1.3251, your hedge would result in a "loss" of $0.25/gallon or $31,500 ($0.25 X 126,000 gallons). As a result, you would owe your counter-party $31,500, which would “increase” your actual March ULSD expense by $0.25/gallon, for a net cost equal to your original swap price of $1.3251/gallon.

In the second scenario, let's assume that ULSD prices increase by 20 cents per gallon and that the average price, for each business day in March, is $1.5251/gallon. In this scenario, your hedge would result in a “gain” of $0.20/gallon or $25,200 ($0.20 X 126,000 gallons). As a result, your counter-party would owe you $25,200, which would offset the increase in your actual March ULSD expense by $0.20/gallon. As a result, your net cost would again be $1.3251/gallon.

Purchasing diesel fuel swaps allows diesel fuel end-users, such as fleets, the ability to hedge their exposure to volatile diesel fuel prices. If the price of diesel fuel increases during the term of the swap, the gain on the swap will offset the higher price the fleet pays "at the pump". On the other hand, if the price of diesel fuel decreases during the term of the swap, the gain on the swap will offset the lower price the fleet pays "at the pump". Either way, once the swap is executed, the fleet has turned their unknown, variable cost into a known, "fixed" cost, in this case, $1.3521/gallon.

It's important to note that swaps such as these are based on wholesale prices, as reported by CME Group, Argus, Platts, etc. and as such exclude basis as well as the "retail" price components such as taxes, local distribution costs, etc. Last but not least, while this post focused on hedging diesel fuel, similar strategies can also be used to hedge gasoline, jet fuel, etc.

Editor’s Note: The post was originally published in May 2012 and has been updated to better reflect current market conditions.

2 min read

As crude oil and refined products continue to decline, we're hearing from many commercial and industrial fuel consumers who are looking for...

4 min read

As companies begin to plan for the second half of the year, we’ve been fielding numerous inquiries from companies who are interested in developing a...

3 min read

As a continuation of our September and August Energy Hedging Q&A posts, here are the questions and our answers to this months Energy Hedging Q&A. As...