3 min read

Bunker Fuel Price Risk Management - Crude Oil Options & Crack Spread Swaps

As many participants in the bunker fuel market are constantly seeking better strategies to hedge their exposure to fuel price risk, we wanted to...

2 min read

Mercatus Energy : Apr 1,2012

As many organizations are struggling with high fuel (gasoline, bunker fuel, diesel fuel, jet fuel, etc.) prices, one hedging strategy which isn't often utilized, but may deserve consideration, is a participating fuel swap.

In essence, a participating swap is the combination of swap and a put option. What makes a participating swap different than the combination of a swap and a put option is that with a participating swap, the premium for the put option is embedded into the price of the swap. As such, the buyer of the participating swap accepts a higher price on the swap in exchange for not having to make an "out of pocket" payment for the put option.

A) It protects you against rising diesel fuel (heating oil) prices

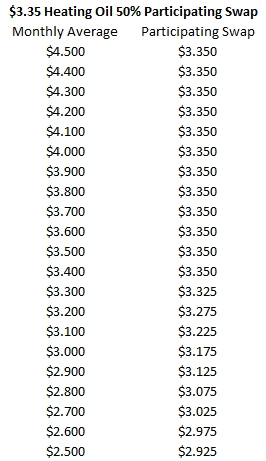

B) If heating oil futures average below the price of the swap, only 50% of your fuel is hedged at $3.35

C) You do not have to pay for the put option (the participating component of the swap) upfront as the premium is embedded into the price of the swap

Moving forward with this example, if prompt month heating oil futures during the month of June averages more than $3.35/gallon, you will receive a payment from your counter-party which is equal to the average price, minus $3.35, multiplied by 100,000 gallons. As a result, this means that if the average price is over $3.35, you net cost will be $3.35/gallon.

Conversely, if prompt month heating oil futures during the month of June averages less than $3.35/gallon, you will receive a payment equal to $3.35 minus the average price, multiplied by 50,000 gallons (100,000 X 50%) from your counter-party. As a result, this means that if the average price is below $3.35, you net cost will be $3.35 on 50,000 gallons (50% of 100,000 gallons) and the average price on the other 50,000 gallons (50% of 100,000 gallons). As an example, if the prompt month heating oil futures during June average $3.00/gallon, your net cost would be $3.175/gallon.

As the example indicates, the participating swap is very similar, yet different, than the combination of a swap and a put option. The are two primary differences:

1) If you were to purchase a fixed price swap on 100,000 gallons and a put option on 50,000 gallons, you would be required to pay an upfront premium of $0.10/gallon for the put option.

2) If you were to purchase a fixed price swap, the swap price would be $2.25 ($3.35 - $0.10) as the cost of the put has been embedded into the swap, thus making the participating swap 10 cents higher than the going market price for a June, average price, heating oil swap.

Note: This example ignores the basis risk between cash diesel fuel prices and heating oil futures.

3 min read

As many participants in the bunker fuel market are constantly seeking better strategies to hedge their exposure to fuel price risk, we wanted to...

2 min read

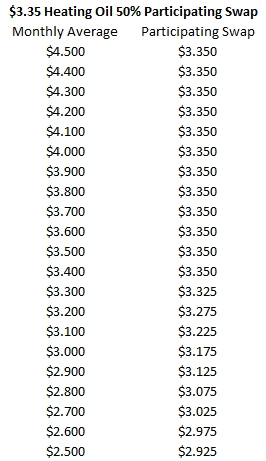

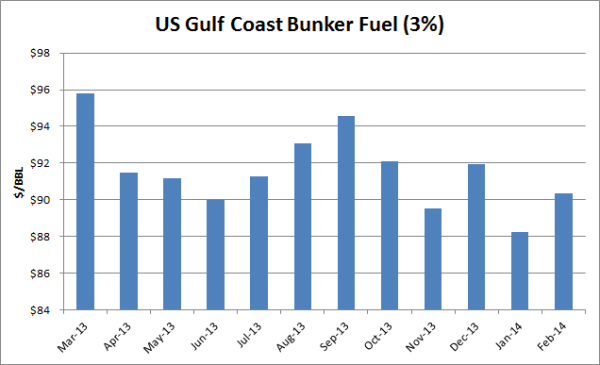

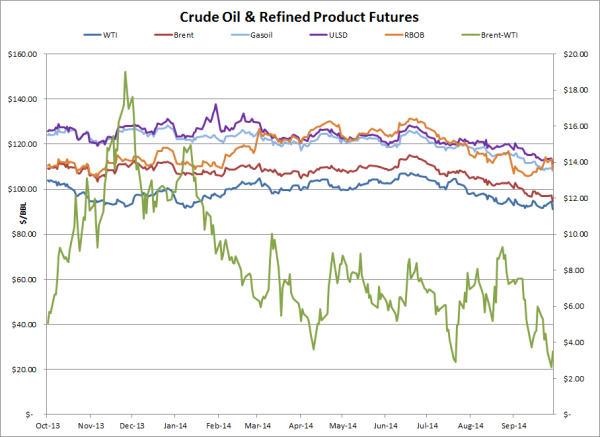

After reaching 2014 highs in late June, crude and product prices have declined significantly over the past few months cumulating with the largest one...

3 min read

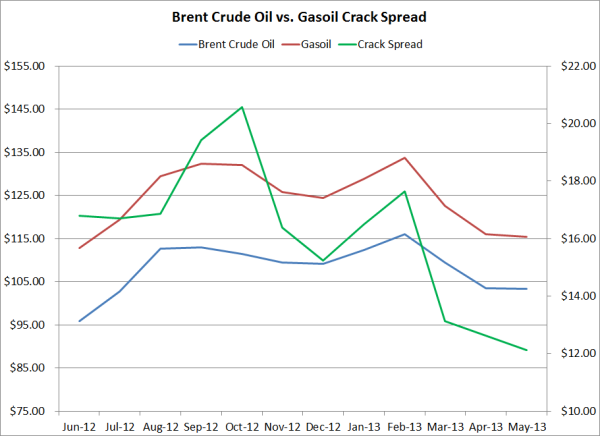

Over the past year, refining profit margins have been quite volatile. As an example, Brent crude oil/gasoil calendar swap crack spreads have traded...