2 min read

Crude Oil Risk Management With Participating Swaps

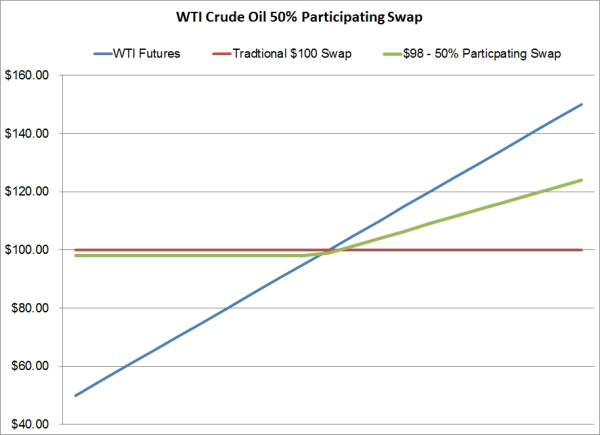

At the request of one of our subscribers, this post addresses how E&P companies can hedge their crude oil price risk with participating swaps. A...

2 min read

Mercatus Energy : Jun 12,2012

As a result of the recent decline in crude oil prices, we've received a couple of inquires from companies wanting to know how they can turn their existing fixed price swaps, which are now in-the-money, into put options. The idea being that such a conversion will provide them with continued protection against declining oil prices while allowing them to benefit should oil prices reverse course and move higher from here.

The simple solution would be to sell their existing swaps and purchase put options. However, the simple solution is more expensive than an alternative strategy which can provide the same/similar risk profile at a lower cost. So what is the alternative strategy? In trading jargon, it's called a "synthetic" put option. In practice, it is the combination of a swap and call option, the combination of which creates a risk profile which is mirrors that of a put option.

As an example, let's assume that Red E&P's has sold a July 2012 $100 WTI calendar swap. This swap is currently trading for approximately $83 so Red's position is currently $17/BBL in-the-money. If Red were to sell the swap, for an approximate gain of $17, they could then purchase an $83 July 2012 WTI Asian (average price) put option for approximately $3.50/BBL. However, as previously mentioned, this is an "expensive" way to accomplish their goal as they would have to execute two transactions (buy the swap and then purchase the put option), which would subject them to the "bid/ask spread" on both occasions. In layman's terms, this means that they would have to compensate their counter-party (via the counter-party's profit margin on each transaction) on both the purchase of the swap and the purchase of the put option.

As an alternative, which would result in the same risk profile, yet at a lower cost, Red could simply purchase an $83 July 2012 WTI Asian (average price) call option, also trading at approximately $3.50/BBL. By retaining their existing swap and purchasing the call option, Red only has to enter into one new transaction, which means that they are only subjected to the bid/ask spread on one transaction.

So how can the $83 synthetic put option provide Red with the same risk profile as exiting the $100 swap and subsequently purchasing an $83 put option? In essence, the existing $100 swap continues to provides Red with a hedge against further price declines while the $83 call option will provide them with a dollar for dollar "profit" should July WTI prices average more than $83/BBL.

In summary, by converting a stand alone, fixed price swap into a synthetic put option, via the purchase of a call option, you can obtain the same risk profile as that of purchasing an outright put option, albeit at a lower cost as you are only subjected to the bid/ask spread on one occasion.

2 min read

At the request of one of our subscribers, this post addresses how E&P companies can hedge their crude oil price risk with participating swaps. A...

3 min read

Financial derivatives do not always provide satisfactory risk mitigation. Your risk profile may be more deeply exposed to risks beyond commodity...

3 min read

In recent weeks, there have been a lot of stories floating around about the "oil storage trade" but we've yet to see a good layman's explanation of...