2 min read

Bunker Fuel Hedging & Price Risk Management - Call Option Spreads

This post is the fourth in a series on hedging bunker fuel price risk. The first post in the series, An Introduction to Bunker Fuel Hedging,...

In the first post in this series, Bunker Fuel Hedging & Price Risk Management - Swaps, we examined how companies in the maritime and shipping industries can hedge their exposure to volatile bunker fuel prices with a strategy known as a fixed price swap.

In addition to swaps, it's also possible to hedge bunker fuel price risk with various other instruments such as call (caps) and put (floors) options. As an example of how a marine fuel consumer (end-user) can hedge their bunker fuel price risk with an option based strategy, let's assume that you're a ship charterer looking to ensure that your September bunker fuel cost in NW Europe does not exceed your budgeted cost of $250/MT.

In order to accomplish this you could purchase a $250/MT September call option on Platts Rotterdam 3.5% fuel oil from your counterparty (i.e. a financial institution, oil company or energy trading company). In this case, let's assume that the premium cost of a $235/MT September Platts Rotterdam 3.5% fuel oil call option is $14.75/MT, which would have been the approximate price as of the close of business yesterday. Let’s further assume that you are hedging 2,500 MT. Given the strike price of $235/MT and the premium of $14.75/MT, you are assured that your September bunker fuel cost will be a maximum of $249.75/MT.

Now let's calculate how this option will impact your net bunker fuel costs in both higher and lower price environments during the month of September.

In the first scenario, let's assume that bunker fuel prices increase and that the average price for Platts Rotterdam 3.5% fuel oil during the month of September is $285/MT. In this scenario, your hedge would result in a "gain" of $50/MT ($285 - $235 = $50) or $125,000 ($50 x 2,500 MT). As a result, you would receive a payment of $125,000 from your counterparty, which would offset the increase in your actual bunker fuel cost by $50/MT. However, given that you paid $14.75/MT for the call option premium, your net gain would be $35.25/MT or $88,125. Therefore, your net fuel cost for September would be $249.75/MT or $624,375. On the contrary, if you did not purchase the call option, your net fuel cost for the month would be $285/MT or $712,500.

In the second scenario, let's assume that bunker fuel prices decrease and that the average price for Platts Rotterdam 3.5% fuel oil during the month of September is $200/MT. In this scenario, your hedge would be out-of-the-money which would result in neither a hedging gain nor loss. However this is good news. Given that you hedged with a call option, your actual fuel expense would decrease in line with the market price e.g. $200/MT. As a result, your fuel expense during the month of September would be approximately $200/MT. However, because you did purchase the call option, your net cost would be approximately $214.75/MT or $536,875.

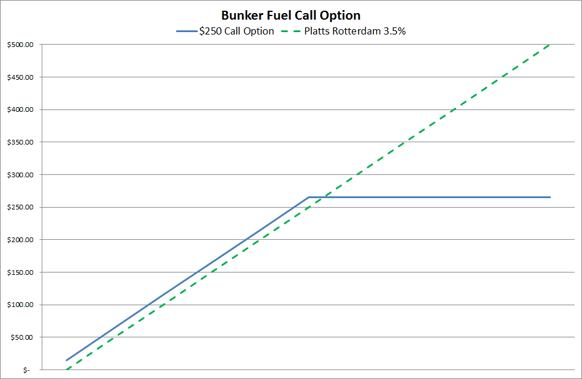

As this example indicates, hedging with call options allows bunker fuel consumers to mitigate their exposure to potentially higher bunker fuel prices while also retaining the ability to benefit from lower bunker fuel prices, should prices decline during the term of the contract.

As the chart indicates, when Platts Rotterdam 3.5% fuel oil is below $250/MT, your cost is the price of Platts Rotterdam 3.5% fuel oil plus $14.75/MT, the premium cost of the call option. Conversely, when Platts Rotterdam 3.5% fuel oil is above $250/MT, your cost is capped at 264.75/MT ($250 + $14.75 = $264.75/MT).

While bunker fuels options are far from the most actively traded product in the energy commodity markets, they do exist and many companies with significant fuel oil price risk would be well served to see determine whether hedging with options is a viable strategy to help them mitigate their exposure to bunker fuel prices.

Last but not least, while this example was based on Platts Rotterdam 3.5%, the same methodology would apply to call options based on the other major bunker markets (Singapore, US Gulf Coast and Arab Gulf) as well.

This article is the second in a series on bunker fuel hedging and price risk management. The previous and subsequent posts is the series can be accessed via the following links:

Bunker Fuel Hedging & Price Risk Management - Swaps

Bunker Fuel Hedging & Price Risk Management - Collars

Bunker Fuel Hedging & Price Risk Management - Call Option Spreads

Bunker Fuel Hedging & Price Risk Management - Three-Way Collars

Editor’s Note: The post was originally published in October 2015 and has been updated to reflect current market prices.

2 min read

This post is the fourth in a series on hedging bunker fuel price risk. The first post in the series, An Introduction to Bunker Fuel Hedging,...

2 min read

As crude oil and refined products continue to decline, we're hearing from many commercial and industrial fuel consumers who are looking for...

3 min read

This post is the second in a series where we are explaining the most common fuel hedging strategies utilized by commercial and industrial fuel...