3 min read

An Introduction to Airline Fuel Hedging Strategies - Swaps

As we've recently received inquires from several airlines who are looking to begin hedging their jet fuel price risk for the first time, we thought...

As crude oil and bunker fuel (fuel oil) prices have been extremely volatile since we originally published this article, we thought it would be best to revise it based on current market prices. As bunker fuel is generally the largest variable cost for companies in the maritime industry, many companies in the industry hedge their bunker fuel price risk using instruments and strategies which are similar to those used to hedge diesel fuel, jet fuel, etc.

The hedging strategy most commonly used to hedge bunker fuel is known as a fixed price swap. The price of these swaps is based on the forward market prices for the most "liquid" (actively traded) bunker fuel price indices such as Platts Gulf Coast 3% fuel oil, Platts Rotterdam 3.5% fuel oil or Platts Singapore High Sulfur fuel oil 380 CST. As an example, let's assume that you are a shipping company seeking to hedge your Asian bunker fuel price exposure for the month of September. As such decide to purchase a Platts Singapore High Sulfur fuel oil 380 CST swap at the current market price of $243/MT (approximately $38.26/BBL based on a conversion factor of 1 MT = 6.35 BBLs).

As an aside, if you were looking to purchase a September bunker fuel swap to hedge your NW Europe (Platts 3.5% Fuel Oil FOB Rotterdam) bunker price risk, you could do so for $226.66/MT. Similarly, the current market price for a September US Gulf Coast bunker fuel swap (Platts Gulf Coast No. 6 3.0% Waterborne Fuel Oil) is $35.07/BBL ($222.69/MT)

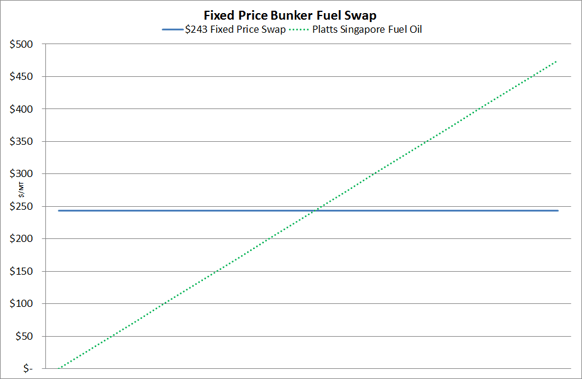

By purchasing the $243 swap, you have effectively fixed your September bunker fuel cost at $243/MT, regardless of what the spot price for Singapore fuel oil during the month of September (excluding your supplier’s profit margin, regional basis differential and taxes, if applicable).

So how does the swap perform if prices are higher than $243 during the month of September? If the price of Platts Singapore High Sulfur fuel oil 380 CST during the month of September averages $285/MT, your supplier would send you an invoice for $285/MT for the physical bunkers (again, excluding your supplier’s profit margin, regional basis differential and taxes, if applicable) and you would receive a hedging gain of $42/MT ($285-$243=$42/MT) from your swap counterparty.

On the other hand, if Platts Singapore High Sulfur fuel oil 380 CST averages $210/MT during the month of September, your supplier would send you an invoice for $210/MT for the physical bunkers and you would owe your swap counterparty $33/MT ($243-$210=$33/MT). As the following chart indicates, when you purchase a fixed price swap, you are "locking in" your bunker fuel cost, for better or worse. That is, when you purchase the swap for $243/MT, you effectively fix your bunker fuel cost at a price of $243/MT.

A fixed price swap might not be the ideal bunker fuel hedging strategy if you need to be able to benefit from potentially lower bunker fuel prices as well, should prices decline. As an alternative, you might want to consider hedging your bunker fuel price risk with an option based strategy such as a call option, costless collar, three-way collar or call option spread. While these strategies are beyond the scope of this article, we'll cover various strategies regarding bunker fuel price risk management with options in subsequent posts.

Also, it should be noted that the market for bunker fuel options isn't extremely liquid in all markets. As a result, you might need to consider employing an option based strategy utilizing Brent or WTI crude oil as the market for crude oil options is much more liquid. The primary challenge with this approach is that you may be exposing yourself to significant basis risk as the correlation between bunker fuel and crude oil isn’t one-to-one. Better said, the price of bunker fuel can increase as the price of crude oil decreases or vice versa. At the end of the day, if you are going to hedge bunker fuel with options, you'll have to determine your risk tolerance as it relates to liquidity vs. basis risk. That being said, it is possible to hedge bunker fuel price risk with the combination of a crude oil call option and a bunker fuel crack spread swap, a strategy we will explain in a future post.

UPDATE: This article is the first in a series on bunker fuel hedging and price risk management. The subsequent posts can be found via the following links:

Bunker Fuel Hedging & Price Risk Management - Call Options

Bunker Fuel Hedging & Price Risk Management - Costless Collars

Bunker Fuel Hedging & Price Risk Management - Call Option Spreads

Bunker Fuel Hedging & Price Risk Management – Three-Way Collars

Editor’s Note: The post was originally published in October 2015 and has been updated to better incorporate current market conditions.

3 min read

As we've recently received inquires from several airlines who are looking to begin hedging their jet fuel price risk for the first time, we thought...

2 min read

In a previous post,An Alternative Oil Hedging Strategy Using Three Way Collars,we explored how oil and gas producers can implement a conservative...

3 min read

This post is the second in a series where we are explaining the most common fuel hedging strategies utilized by commercial and industrial fuel...