2 min read

When Should You Hedge Your Natural Gas Price Risk?

As energy hedging advisors, natural gas consumers, producers and marketers regularly ask us for advice regarding hedging their natural gas price...

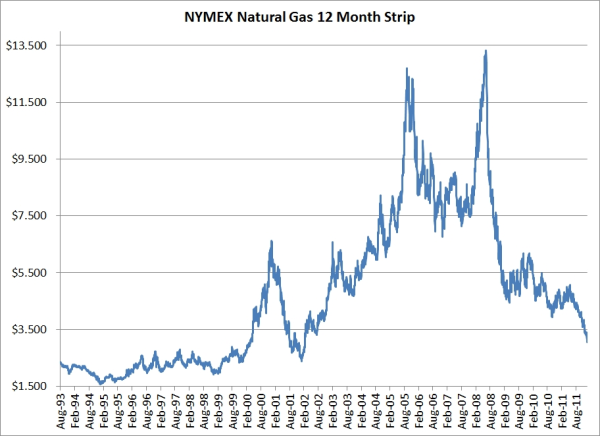

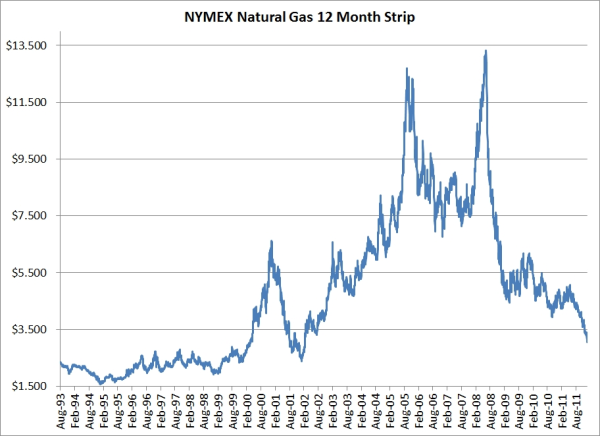

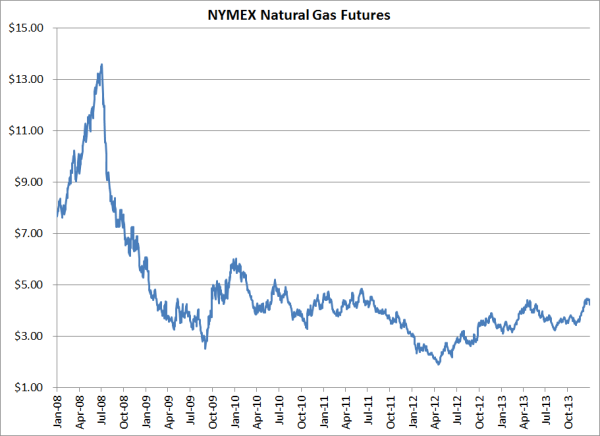

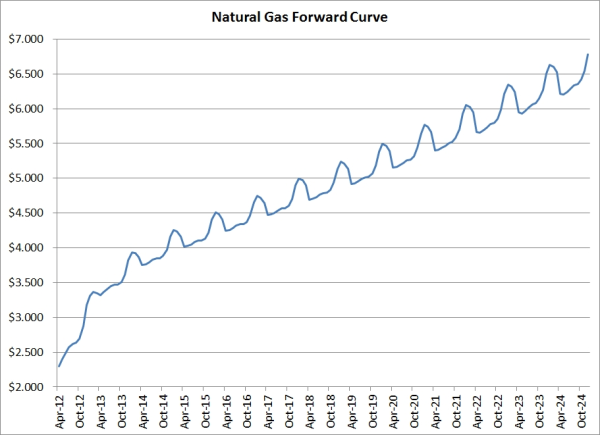

Despite the fact that January is supposed to be the beginning of peak winter demand for natural gas, prices continue to plummet due to a combination of an ever increasing supply and weak demand. Prompt month NYMEX futures settled yesterday at $2.697, the lowest prompt month settlement since September 3, 2009. The forward curves are trading at even lower levels, relative to historical prices. The one year strip settled at $3.062, the lowest settlement of a one year forward curve since March 6, 2002. It's also been nearly ten years since the two and three year strips have traded as low as they did yesterday, settling at $3.418 and $3.687, respectively. Recall that is was as recent as the summer of 2008 when the one, two and three year curves were all trading in the $12-13 range.

While we never advocate speculating (unless that is indeed your intent), nor are we in the business of commodity price forecasting, the vast majority of commercial and industrial natural gas consumers in North America would be well served to take a hard look at hedging natural gas prices at current price levels. Sure, there is a decent probability that prices will continue to decline but, if prices fall much further, producers will be forced to forced to slow down or cease drilling, not to mention shutting in production. A decade or two ago many producers could scratch out a profit at $2.50/MMbtu, but that's simply no longer the case for all but a few.

Last but not least, as we've advocated numerous time before, one shouldn't decide to initiate a hedge(s) simply because current prices appear to be attractive. A proper natural gas hedging initiative should always include a well thought out hedging policy and strategy(s), regardless of whether current and forward prices are perceived to be low, high or somewhere in between.

2 min read

As energy hedging advisors, natural gas consumers, producers and marketers regularly ask us for advice regarding hedging their natural gas price...

3 min read

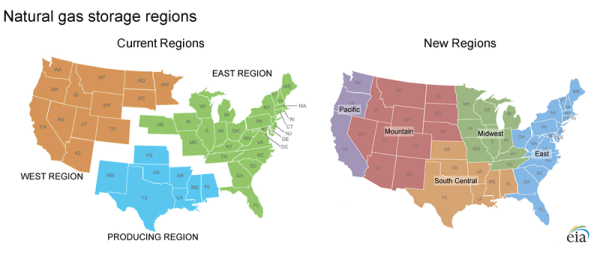

The EIA will release its weekly natural gas storage report tomorrow (one day early due to the Thanksgiving holiday) and it’s likely the agency will...

2 min read

The prompt month natural gas futures contract (April) settled yesterday at a ten year low, $2.281/MMbtu. The last time the prompt Henry Hub futures...