2 min read

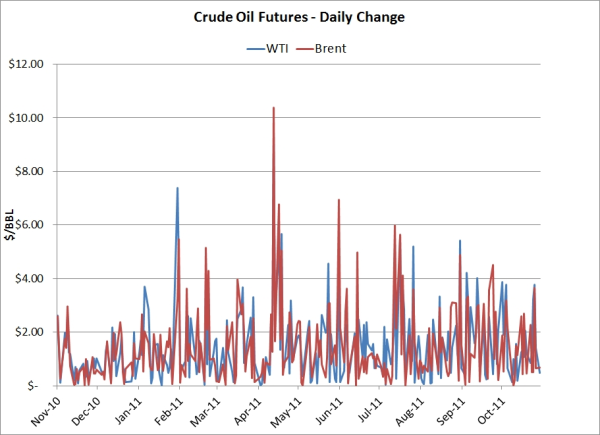

Brent-WTI Crude Oil Spread Continues to Collapse

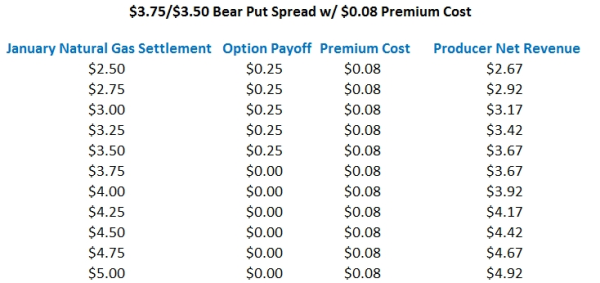

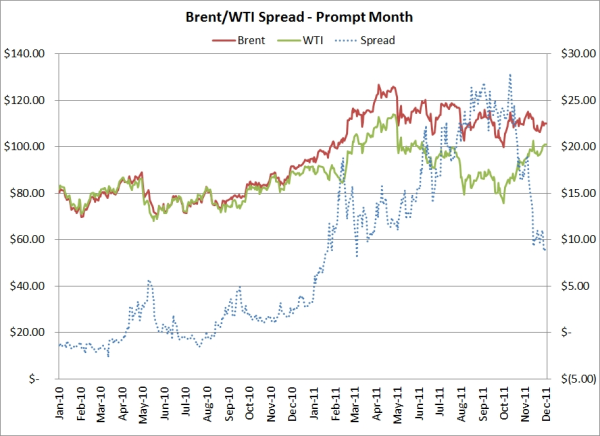

After topping out in October at $27.88/BBL, the Brent-WTI spread continues to collapse, settling yesterday at $8.82/BBL, the lowest level in nearly a...

Given the significant volatility which is currently wreaking havoc on many energy market participants, especially natural gas producers, we thought we would explore a potential, hedging strategy which may be beneficial to some natural gas producers in the current price environment.

For starters, let's assume that a natural gas producer is searching for a hedging strategy which takes the following criteria into account:

Based on the above mentioned items, one natural gas hedging strategy which might be attractive to the producer is a bear spread, also known as a put spread. A bear spread involves purchasing a put option with a "high" strike price and selling a put option with a lower strike price. The combination of these two options provides the producer with a hedge between the strike price of the "high" strike option and the strike price of the "low" strike option.

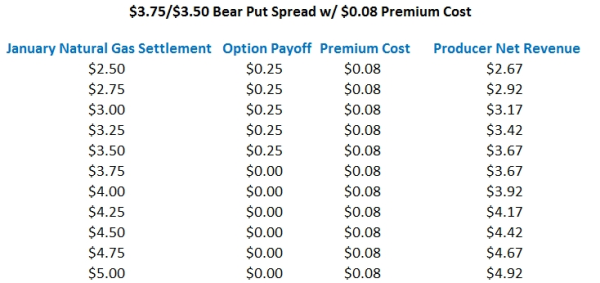

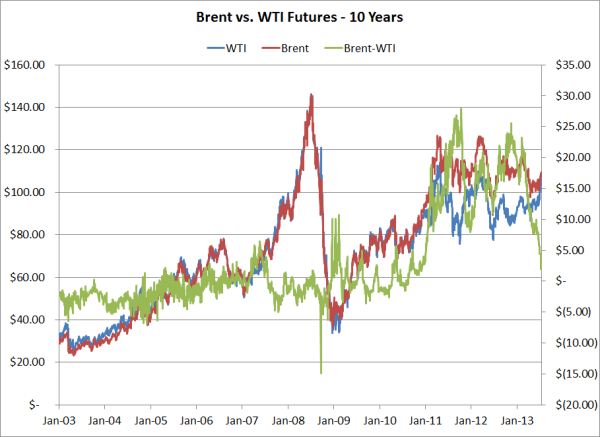

As an example, let's assume that the producer is concerned that January natural gas prices will decline below their current level of $3.781/MMBtu, per today's NYMEX settlement. In this scenario the producer could enter into a bear spread by purchasing a January $3.75 put option for $0.14/MMBtu and selling a January $3.50 put option for $0.06/MMBtu, which would require a net premium payment of $0.08/MMBtu.

The $3.75/$3.50 bear spread would provide the producer with a hedge against the January contract settling below $3.75 with a maximum payout of $0.25. The maximum payout is $0.25 because the $3.50 put option would be exercised against the producer if the January contract settles below $3.50. On the other hand, if the January contract were to settle above $3.75, the producer would simply be out the upfront premium cost of $0.08.

As the chart above indicates, a bear spread can be an effective hedging strategy against smaller price declines but, if prices decline significantly, the producer's hedge is indeed minimal. Hence, the bear spread is a strategy that the producer might consider, as it meets all three of their criteria: provides a short term hedge against a minimal price decline, allows upside participation if prices increase and requires a relatively inexpensive premium payment.

As always, we would argue that a sound, long-long term hedging program does not involve speculation. Hence, we should classify this strategy as a "hedgulation" or "spechedge"(hedging + speculation) strategy as the producer is taking a position based on their opinion that natural gas prices may decline, but not by much. If the producer were looking to initiate a conservative, long-term hedging program, we would argue that they should probably consider outright put options or possibly collars or swaps, rather than a bear put spread. It should be noted that oil and gas producers can also employ bear spreads on crude oil and natural gas liquids as well.

Last but not least, as is often the case when we're exploring many hedging strategies, the bear spread strategy explained above does not address the producer's potential exposure to basis risk.

2 min read

After topping out in October at $27.88/BBL, the Brent-WTI spread continues to collapse, settling yesterday at $8.82/BBL, the lowest level in nearly a...

2 min read

As the Brent-WTI spread is trading at it's lowest level since November 2010 and crack spreads shifting as a result, it's time that we take another...

2 min read

It can't be denied that the recent volatility in the oil and fuel markets is proving to be quite challenging for many companies with active hedging...