3 min read

September Energy Hedging Q&A – Gasoline, Natural Gas & NGLs

Based on the positive feedback we received from the August Energy Hedging Q&A, we're going to make the hedging Q&A a permanent, monthly feature. The...

In what has become a monthly feature of our blog, the following is our March energy hedging Q&A. As always, if you would like us to provide a more in depth answer to any of these questions or if you’d like to ask us a question for next month’s Q&A, let us know. Comments below are more than welcome as well.

How can a refiner hedge the crack spread/profit margin?

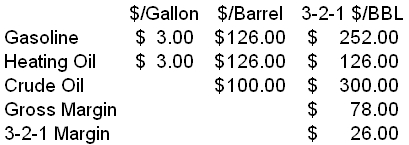

For simplicity, let's assume that you are a refiner looking to lock in your profit margins and that your refinery(s) is similar to the textbook 3-2-1 formula. That is, for every barrel of crude, you produce 2 barrels of gasoline and 1 barrel of distillate (diesel, heating oil, jet fuel, etc.).

Further assume that on April 15, you committed to buying 90,000 barrels of physical WTI crude oil, rateably during the month of May, at the prevailing market price in the spot (cash) market. You also have obligations to sell 60,000 barrels of gasoline and 30,000 barrels of heating oil, rateably during the month of June, prevailing market price in the spot (cash) market.

In order to hedge your exposure to the 3-2-1 crack spread, that same day, April 15, you could enter into a long hedge in crude oil and short hedges in gasoline and heating oil. You could accomplish this by purchasing 90 May WTI crude oil swaps while selling 60 June gasoline swaps and 30 June heating oil swaps.

If you purchased the May crude oil swaps at $100/BBL, sold the June gasoline swaps at $3.00/gallon ($126/barrel) and sold the June heating oil swaps at $3.00/gallon, you would be hedging or locking in your 3-2-1 crack spread at $26/BBL. As a result, regardless of whether crude oil, gasoline and/or heating oil prices increase or decrease between April 15 and June 30, the refiners profit margin on the 90,000 barrels hedged will be $26/BBL.

Note that this example ignores calendar and locational basis risk.

If we wanted to hedge the balance of our 2011 production with costless collars and we want our floor on oil to be $95/BBL and our floor (put option) on natural gas to be $4.00/MMbtu, approximately what would the strike prices be on the ceilings (call option)?

As of this minute, in order to enter into an April '11 - Dec '11 WTI costless collar with a $95/BBL put option you would need to sell a call option at approximately $120/BBL. On the natural gas costless collar, in order to obtain a $4.00 put option you would need to sell a call option at approximately $5.25/MMbtu.

Note that these prices are only indications and the actual price at which you can execute such trades will vary based on numerous factors such as the current NYMEX prices, volatility, time to expiration, bid/ask spreads, whether you are executing over-the-counter or on the exchange, etc.

We know we need to hedge but we have no idea where to begin the process. How do we find out what banks, brokerage firms or trading companies will deal with a company like ours?

Contact us and we'll do our best to connect you with potentially, appropriate counter-parties and/or clearing firms. In the meantime, feel free to spend a few minutes browsing our website, particularly services section, which provides a brief explanation of the various services that we perform for our clients, many of which were once in your shoes and didn't know where to begin the process.

If you'd like to pose a question for the April Q&A please leave a comment or send us an email.

3 min read

Based on the positive feedback we received from the August Energy Hedging Q&A, we're going to make the hedging Q&A a permanent, monthly feature. The...

1 min read

Without further ado, the following are our answers to your May energy hedging questions. As always, if you would like us to provide more depth or...

2 min read

In what has become a monthly feature of our blog, here is the November energy hedging Q&A. As always, if you would like us to provide a more in...