3 min read

A Beginners Guide to Fuel Hedging - Call Options

This post is the third in a series where are addressing the fuel hedging strategies most utilized by commercial and industrial fuel consumers. The...

2 min read

Mercatus Energy : Oct 15,2014

As crude oil and refined products continue to decline, we're hearing from many commercial and industrial fuel consumers who are looking for "opportunistic" hedging strategies that will protect them against higher prices while not exposing them to downside price risk, should prices continue to decline from here. While most fuel consumers tend to hedge with traditional strategies such as swaps, call options and costless collars, markets with strong downward (as well as upward) momentum, such as the current one, tend to cause many hedgers to want to think outside of the box.

While we would argue that a strong bearish market is an ideal situation for fuel consumers to hedge with outright call options, many are strongly opposed (or can't justify the cost) to buying outright call options due to the premium cost. So what other strategies might make sense for a fuel consumer looking for an opportunistic hedge in this environment? One strategy to consider is a bull call spread, also known as a call option spread. A bull call spread is simply the combination of buying one call option, with a "low" strike price, and selling another call option, with a "higher" strike price. The basic premise of this strategy is that you are hedged if prices rise above the strike price of the lower cost option, up to the strike price of the higher strike price, with a minimal or reduced out of pocket cost.

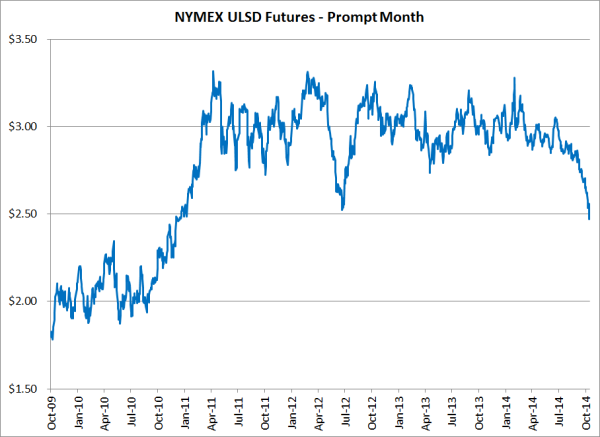

As an example, let's say you're looking to hedge your November diesel fuel consumption. If we look at the forward market for December NYMEX ULSD futures (December futures are the prompt month during the month of November), we see that they are currently trading hear $2.47/gallon. Let's also assume you want to be hedged against NYMEX ULSD prices rising above $2.55/gallon. Furthermore, as previously mentioned, let's assume that your willingness to pay option premium is minimal and that you do not want any downside risk exposure should NYMEX USLD prices trade lower between now and then end of November.

One potential strategy to consider given your requirements is a $2.55/$2.70 NYMEX ULSD bull call spread, which would entail purchasing a $2.55 NYMEX ULSD call option and selling a $2.70 NYMEX ULSD call option. The $2.55 call option is currently trading for about $0.0450/gallon while the $2.70 call option is currently trading for about $0.0150/gallon. Therefore, the net cost of the $2.55/$2.70 NYMEX ULSD bull call spread is currently about $0.03/gallon.

As the chart above indicates, by hedging with a $2.55/$2.70 NYMEX ULSD bull call spread, you are hedged against prices rising above $2.55/gallon up to $2.70/gallon, at which point your maximum gain on the position would be $0.15/gallon (or a net of $0.12/gallon including the initial premium cost of $0.03/gallon). In addition, this position does not expose you to downside price risk should ULSD prices continue to decline from here. In fact, by hedging with a bull call spread, you would be well positioned to benefit from lower prices such that your net cost would simply be the NYMEX ULSD monthly average price plus the $0.03/gallon premium paid for the call option spread.

The "downside" to hedging with spreads on options, such as the bull call spread explain above, is that your maximum potential gains are limited. As mentioned above, in this example, if NYMEX ULSD prices during the month of November average more than $2.70/gallon your gain would be limited to $0.15/gallon (or $0.12/gallon including the premium cost).

In summary, for commercial and industrial fuel consumers who are looking for a low cost, no-risk diesel fuel hedging strategy, call option spreads are one strategy worth consideration. In addition, this strategy is not limited to diesel fuel. Call option spreads are available on nearly every energy commodity with an actively traded option market. If you would like to discuss how you might utilize a call option spread or any other hedging strategy, feel free to give us a call.

3 min read

This post is the third in a series where are addressing the fuel hedging strategies most utilized by commercial and industrial fuel consumers. The...

3 min read

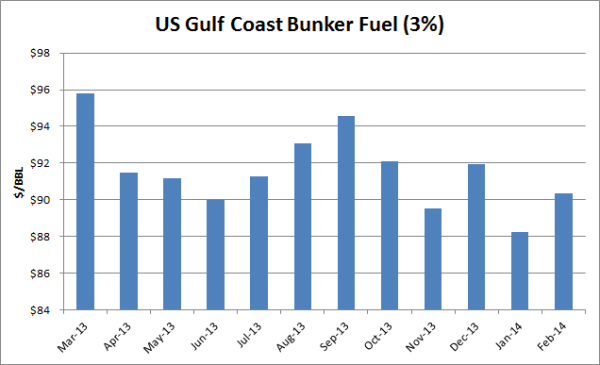

As many participants in the bunker fuel market are constantly seeking better strategies to hedge their exposure to fuel price risk, we wanted to...

3 min read

This post is the second in a series where we are explaining the most common fuel hedging strategies utilized by commercial and industrial fuel...