Crude Oil & Products Selling Off - What Is Your Hedging Strategy?

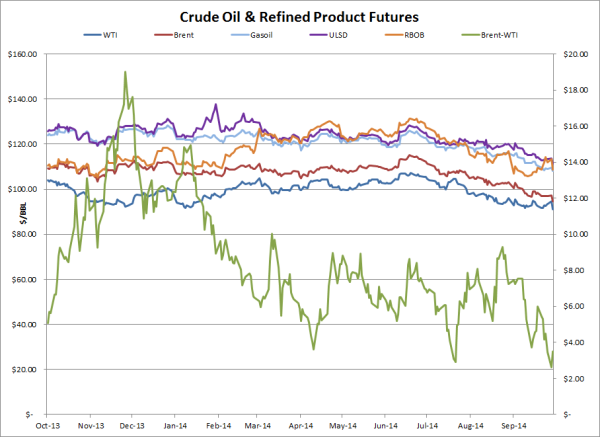

After reaching 2014 highs in late June, crude and product prices have declined significantly over the past few months cumulating with the largest one day losses (both on an absolute and percentage basis) of the year in prompt WTI, Brent, ULSD and RBOB gasoline futures (excluding days where futures rolled forward to a new prompt month). Why?

- The world is well supplied with crude thanks to strong production in the US and rebounding production from the likes of Libya. In addition, due to the strong production in the US, imports into the US are declining which equates to an effective increase in supply outside of the US.

- It’s the end of the third quarter and many traders are liquidating long positions in an effort to flatten their books before they close the quarter, not to mention reactions to the bearish fundamentals noted above. According to the latest CFTC report, speculators reduced their net long positions in WTI by 4.8% over last week. In addition, there are indications that several large funds are exiting energy commodities, following the many others which have exited the business in recent months and years.

- The strength of the dollar. The USD index, which measures USD vs. a combination of EUR, JPY, GBP, CAD, SEK and CHF, rose 7.7% during the quarter, the largest quarterly increase since the third quarter of ’08. And a strong dollar generally leads to lower commodity prices.

- The expiration of the October ULSD and RBOB gasoline futures.

So given the current market environment, how should one hedge their oil (fuel) price risk? As we highlighted in our last post, we’re generally of the opinion that hedging decisions should be based on the economics of your business and your risk tolerance, not your current opinion about the market.

Recall that in 2007-2008, crude oil prices (Brent in this case) rose from $50 to $147 in only seven months, followed by a collapse to $36 in the following five months and a subsequent rise back to $125 over the next two and a half years. Could we be in the early stages of the next major bear market? The fundamentals would indicate that that is indeed the case but as “noisy” as the crude and product markets have been in recent months, one could well argue that we’re only a major headline away from a correction, even if doesn’t last more than a few weeks.

That being said, in uncertain market environments such as the current one, we tend to favor strategies which are net long options, which could mean being long an outright option, long an option spread or long a three-way collar, all of which have defined maximum risk. For companies with a limited risk tolerance, low-cost, conservative option hedging strategies do exist and are arguably very well suited for an environment such as the current one. It all comes down to determining your risk tolerance and how much capital you are willing to allocate to mitigate your exposure in the form of option premiums.

If your company is a fuel consumer and you're interested in learning more about option-based hedging strategies which might be a good fit in the current environment, check out the following posts:

A Beginners Guide to Fuel Hedging with Call Options

Fuel Hedging In Volatile Markets with Call Option Spreads

On the other hand, if you’re an oil and gas producer interested in option-based hedging strategies which might be a good fit for your business, see the following posts:

The Fundamentals of Oil & Gas Hedging with Put Options

A Low Cost Natural Gas Hedging Strategy for E&P Companies

As for refiners, processors and others who are exposed to cross-commodity price risk and would like to learn more about hedging with long-option based strategies, see the following post:

Hedging Refining Profit Margins with Crack Spread Options

In closing, if you’re concerned about your exposure to oil prices in the coming weeks and months as well as being on the wrong side of the market, you’re likely to find that long-option based hedging strategies fit your need as they provide not only "insurance" against adverse price changes but also ensure that you don’t find yourself with a cash flow or balance sheet problem as a result of a large, unwelcome hedging loss.