Fuel Hedging In Volatile Markets With Call Option Spreads

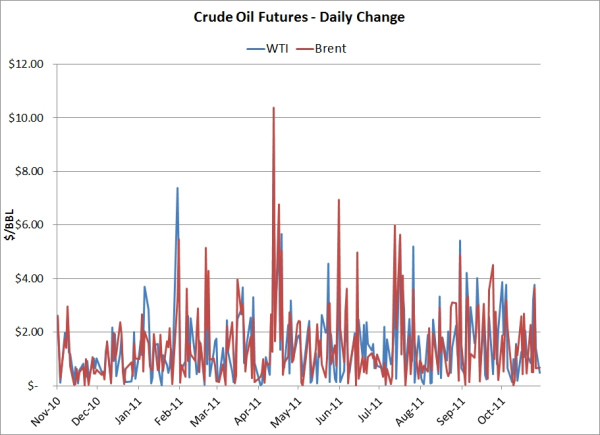

It can't be denied that the recent volatility in the oil and fuel markets is proving to be quite challenging for many companies with active hedging initiatives. Regardless of whether you're a producer, consumer, refiner or marketer, managing the day to day volatility can be quite difficult to say the least. In the last month alone, the average daily change in front month WTI crude oil futures has been $1.63/BBL. During the same time, the average daily change for Brent has been $1.37/BBL. On the fuel side, the average daily change for front month heating oil, RBOB gasoline and gasoil futures, over the past month, has been $0.03167/gallon, $0.0390/gallon and $8.50/MT, respectively.

And these are only the average daily price moves. If we look at the bigger picture, the cumulative daily changes over the past month alone are staggering: $34.16/BBL on WTI, $28.82/BBL on Brent, $0.665/gallon on heating oil, $0.8196/gallon on heating oil and $178/MT on gasoil.

Which begs the question, what is a conservative, "low" cost, fuel hedging strategy that provides adequate protection while mitigating the exposure to day to day volatility? Let's examine how one can hedge with a call option spread.

In practice, if you're a fuel consumer (air, marine, rail, road, etc.) and are looking for a fuel hedging strategy to mitigate your exposure to rising fuel prices while also allowing you to benefit if fuel prices decline, a call spread might be something to consider. A call spread is simply the combination of buying one call option and selling another call option whose strike price is higher than that of the first option.

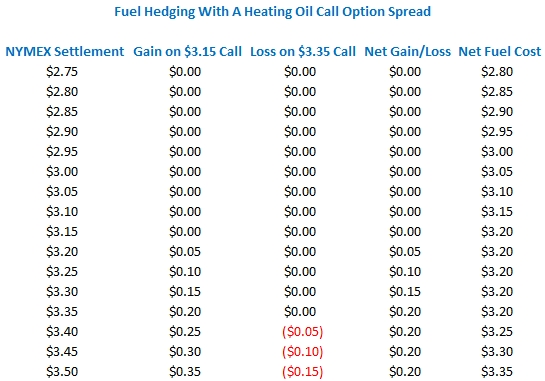

As an example, let's say you're looking at hedging your January 2012 fuel consumption with a call option spread. Looking at the futures, you see that February heating oil futures (which is the prompt month futures contract during the actual month of January) are at $3.00/gallon and you want to be hedged if heating oil prices move above $3.15/gallon. In addition, you can only afford to spend $0.05/gallon on option premium. What do you do?

One potential strategy is to purchase a January $3.15 average price heating oil call option for approximately $0.0850/gallon. However, you only want to spend $0.05/gallon so you need to determine what call option to sell in order to reduce your cost to $0.05/gallon. A $3.35 call option is trading near $0.0350/gallon so you decide to sell this option thus providing you with a $3.15/$3.35 call option spread at a cost of $0.05/gallon. In short, buy spending $0.05/gallon, you have hedged yourself against the cost of heating oil rising above $3.15/gallon to a maximum of $3.35/gallon or $0.20.

The following chart shows the impact of this fuel hedging strategy when the NYMEX heating oil futures settle between $2.75 and $3.50 per gallon. The "Net Fuel Cost" includes the $0.05/gallon cost of the option while excluding excluding basis, transportation and taxes.

While this strategy only provides a "minimal coverage," for a company looking for a low cost, conservative fuel hedging strategy, call option spreads are a strategy worth considering during volatile market environments.