Is Vertical Integration A Sound Energy Hedging Strategy?

If you read our blog regularly you've likely to have read one of our posts regarding alternatives to hedging energy price risk with futures, swaps and options i.e. Oil & Gas Hedging Without Futures, Swaps & Options. Chevron ’s most recent quarterly earnings represent a successful application of one of these alternatives – vertical integration. In this post, we review how integration has served as a hedge for Chevron, including reviewing our checklist for when an integrated business is a sound hedging strategy.

Production Declines, Prices Decline, Profit Increases?

You read that headline correctly. During the third quarter of 2014, Chevron’s upstream unit reported lower production volumes and a lower average price for its productionn. Nevertheless, the company reported higher year-on-year net income and beat the most equtiy analyst's forecasts for the quarter (3Q 2014 NI of $2.95/share vs. $2.57 for 3Q 2013 and $2.55 average analyst forecast).

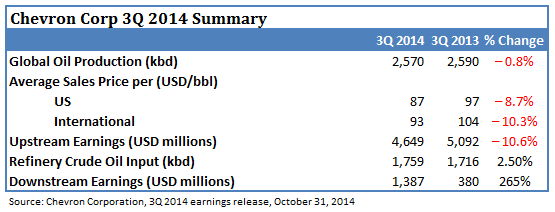

How can this be? Quite simply, Chevron’s downstream unit captured wider margins between the cost of buying oil and the price at which it sold refined products. Let’s take a brief look at the numbers:

A couple of things stand out in this table. Firstly, as mentioned above, Chevron’s downstream unit’s 3Q performance more than offset the lackluster performance of the upstream unit, posting earnings that were $1,007 million higher than reported for the 3Q 2013 vs. a quarter-on-quarter drop in earnings of $443 million for the upstream. Secondly, crude oil inputs to refineries rose modestly, reflecting Chevron’s purchases of third party crude oil. “Despite a decline in crude oil prices, our third quarter earnings were higher than a year ago,” said Chairman and CEO John Watson. “Overall downstream results improved, reflecting the benefits of lower feedstock costs and better refinery reliability, particularly in the U.S.”

Is vertical integration really hedging?

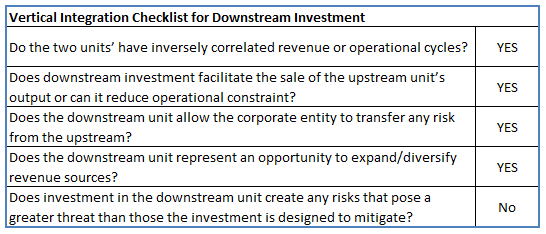

In the previous post where we addressed vertical integration, we offered examples of times when it is worth considering vertical integration investment. To divert capital from your primary business is a difficult decision, especially if the project is quite large. So does Chevron’s vertical integration effectively represent a hedge, even if the firm does not explicitly refer to it as such?

These are general questions. When analyzing a possible vertical integration investment in practice, one should develop a more specific and quantitative approach to evaluating these topics, including an internal evaluation of the ability to manage the investment or consider need to bring in a third party with appropriate expertise.

This quick review of vertical integration for Chevron suggests the downstream is an effective hedge in its role as complimentary business to Chevron’s upstream business. The firm’s upstream and downstream business units are under the same corporate umbrella, but operate independently enough to capture distinctly different market opportunities. Importantly, the downstream unit tends to benefit from market environments that may limit the success of the upstream unit and vice-versa.

Chevron’s vertical integration extends beyond the firm’s investment in refineries. Chevron is involved in a variety of downstream, midstream, and infrastructure businesses, including but not limited to, pipelines, LNG liquefaction facilities, marketing, processing, and storage. For a company of Chevron’s size, vertical integration is likely just a component of its broader strategy to extract maximum value from its upstream portfolio. Furthermore, hedging exclusively with derivatives may even create risk for a company as large as Chevron.

How can you apply this lesson to your business?

Chevron’s 3Q 2014 earnings provide an example of the benefits of vertical integration and why hedging should be as much a function of your global supply chain and operations strategy as the activities carried out by your treasury department. Hedging is less a matter of trading derivatives and more one of risk mitigation, optimizing the operations of your firm and maximizing the value you create.

Even for Chevron with its size and capital, large investment decisions are challenging. They require thorough analysis of the estimated value added, risk mitigated, and cost of entry. Additionally, one should consider whether one’s firm has the expertise to manage such an investment. That said, vertical integration can represent a potential hedging strategy, regardless of the price environments in which your firm operates. As oil prices fall, it is possible that vertically integrated companies, especially those with remote or stranded assets, will weather the storm much better than singularly focused companies. Even small E&P companies face constraint and risks which can be mitigated via midstream and downstream investment.

If you're considering making an investment into a differecnt vertical, go through the checklist above to begin your decision making process. Alternatively, contact us and we can discuss your situtation and how can can help. Chances are, in a low price environment, you may find investments in other verticals are well worth divertying capital from your core business.