Basis Risk Leads to Unexpected Fuel Hedging Results

While we analyze numerous basis relationships across the energy commodity markets on a regular basis, it's rarely a simply task, as the relationships are always changing. One day a forward curve can be in contango and the next week it's backwardated. Similarly, one day one product can be trading at a premium to related product and the following day it's the opposite situation.

So what does this have to do with fuel hedging? In short, we recently spoke with a company who was struggling to determine why their fuel hedging program had not been meeting their expectations. We dug into the data and it appears that their "back of the envelope" analysis indicated that the major bunker fuel indices (US Gulf Coast, Singapore & Rotterdam) were so highly correlated that they need not be concerned with the a "minimal" amount of basis risk. As it turns out, this misunderstanding of bunker fuel price relationships cost them millions of dollars.

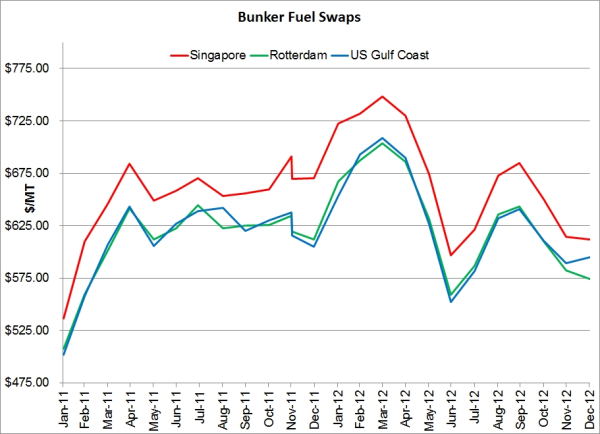

How can such a thing happen when bunker fuel prices are so highly correlated? While it is true that the long term correlations between Singapore, Rotterdam and US Gulf Coast bunker fuel prices are quite strong, the short term price relationships aren't always so. As an example, the following chart shows the monthly settlement prices for Singapore, Rotterdam and US Gulf Coast bunker fuel swaps over the course of the past two years. Indeed, the long term correlations are quite strong. In fact, they are all above 95%.

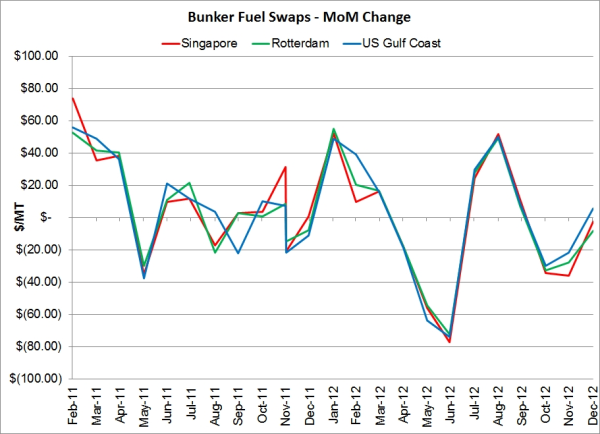

However, when we look at the month-over-month changes in each respective market there are clearly several cases where the long term price relationships break down. Take for example May 2011 through March 2012. As the following chart (which shows the month-over-month change in settlement prices) indicates, the often relied upon long term relationships broke down on several occasions over the past couple years, hence the unexpected hedging results.

So how can you avoid unexpected hedging problems due to changes in basis relationships? For starters, you need to perform sound (not "back of the envelope") analysis of your basis exposure on a regular basis. An always up to date, thorough understanding of your exposure is in terms of geography is crucial as well. If your business is growing or shrinking in any given region(s), your hedging strategy probably needs to change accordingly. Last but not least, it is often possible to mitigate a portion of your exposure to basis risk by hedging with options, as opposed to fixed price instruments, but that beyond the scope of this post (see How to Reduce Basis Risk by Hedging with Options - Part I for more on this topic) .

In summary, misunderstood basis relationships often leads to unexpected hedging results. However, such results can be minimized, if not eliminated, by taking the time to regularly conduct the proper research and analysis.