Chicago & Group 3 ULSD Basis Blowouts Provide Fuel Hedging Lesson

On Friday Chicago ULSD spot prices jumped $0.1875/gallon putting Chicago spot prices at $0.29 over November NYMEX ULSD futures, the highest Chicago ULSD has traded vs. NYMEX since May 2013 when it traded at $0.33 over NYMEX. Similarly, Group 3 ULSD spot prices increased $0.0525 to $0.2625 over NYMEX ULSD futures, the highest it has traded vs. NYMEX since distillate basis differentials began referencing the NYMEX ULSD futures (previously distillates basis differentials referenced NYMEX heating oil futures). What's driving Midwest prices higher? Maintenance at refineries throughout the Midwest and strong agricultural demand for diesel.

While seasonal basis blowouts of this nature are somewhat common in the fuel markets (be it from refinery maintenance, weather, etc), fuel consumers in the Midwest need not be exposed to regional price spikes of this nature. There's a fairly active market for Chicago and Group 3 basis swaps, which can be utilize to hedge against potential events of this nature.

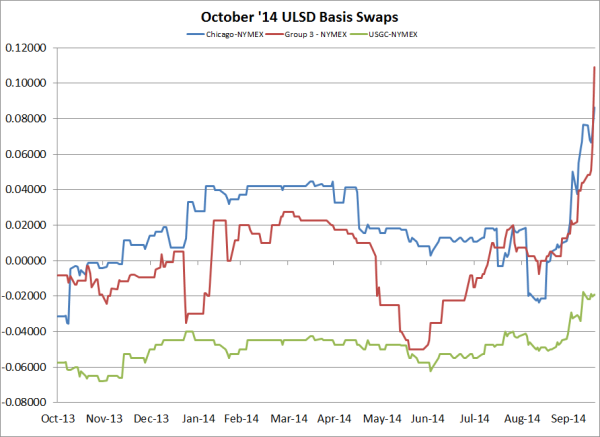

As recent as September 18, an October Chicago-NYMEX ULSD basis swap was trading flat vs. NYMEX ULSD, meaning you could have locked in October Chicago-NYMEX basis at the same price as October NYMEX ULSD swap. In early September, October Chicago-NYMEX ULSD basis swaps traded as low as $0.0235 under October NYMEX ULSD calendar swaps. Clearly NYMEX USLD flat prices have declined significantly in recent weeks but had one hedged their NYMEX ULSD flat price exposure with a long option strategy (call option, call spread, etc.) and their Chicago-NYMEX ULSD basis with a Chicago-NYMEX ULSD basis swap, they would now be enjoying the best of both worlds, lower NYMEX prices and no exposure to the Chicago ULSD basis blowout.

Note: The basis swaps shown in the above chart don't entirely reflect the recent increases as the swaps settle vs. the monthly average, which remains lower than current differentials.

Similarly, October Group 3-NYMEX ULSD basis swaps traded flat vs October NYMEX ULSD calendar swaps as recent as September 15 and as low as $0.0075 under October NYMEX swaps on September 11. Also, while not nearly as significant as the Chicago and Group 3 markets, Gulf Coast ULSD basis has been strengthening as well, with October USGC-NYMEX swaps trading at -$0.0190 on Friday, up from $-0.05 a few weeks ago.

As we have noted on many previous occasions, for most market participants with significant basis exposure, hedging basis risk is more often than not required to produce consistent, successful hedging results. While it's not always possible to hedge basis risk with basis swaps, it is often possible to do so in the physical market by utilizing a contract which references a liquid market i.e. NYMEX ULSD futures, USGC swaps, etc. While the mechanics of physical basis hedging are beyond the scope of this post, we'll address the it in a future post.