Are Crude Oil Prices in the Early Days of a Sustainable Bear Market?

As crude oil prices have declined by over 20% since late June, many are now wondering, are prices approaching a bottom or are we in the early days of a sustainable bear market?

Before we begin to try and answer that question, we need to consider what has driven prices lower in the first place. In short, crude oil supplies have been rising while demand is weak and potentially declining further. Crude oil supplies in the US remain high and are expected to continue to increase due to shale based production while production is increasing in the Middle East and Africa (i.e. Libya). In addition, most of OPEC seems content with the current market environment. According to the organization's most recent official report, OPEC members increased output by 402,000 BPD to 30.47MM BPD in September.

In addition, in recent days, Saudia Arabia, Iraq and Iran have lowered their official selling prices in what appears to be an attempt to retain market share. Furthermore, according to a report out today by Reuters, "Saudi officials have given a different message in meetings with investors and analysts: the kingdom, OPEC’s largest producer, will accept oil prices below $90 per barrel, and perhaps down to $80, for as long as a year or two, according to people who have been briefed on the recent conversations." The article further stated, "The Saudis appear to be betting lower prices – which could strain the finances of some members of the Organization of the Petroleum Exporting Countries – will be necessary to pave the way for higher revenue in the medium term, by curbing new investment and further increases in supply from places like the U.S. shale patch or ultra-deepwater, according to the sources, who declined to be identified due to the private nature of the discussions." On the other hand, there are also reports that Venezuela is seeking an extraordinary OPEC meeting to discuss falling prices. Assuming an extraordinary meeting does not take place before then, OPEC is set to hold their next meeting on November 27 in Vienna.

While it's still early days, we are also starting to hear that some E&P companies are beginning to have internal discussions regarding lowering their 2015 spending plans in the more costly US unconventional plays due to the recent price declines. This is significant as US production is expected to increase by nearly 1MM BPD in 2015.

On the demand side, according to numerous reports published in recent weeks, demand in Europe in the second quarter was approximately 5% lower than in 2013. In addition, demand in Asia (i.e. China, South Korea and India) is believed to be flat or slightly lower than the same time last year. While demand in the US appears to be holding up, data indicates that 2014 year to date demand is only slightly better than the same period last year.

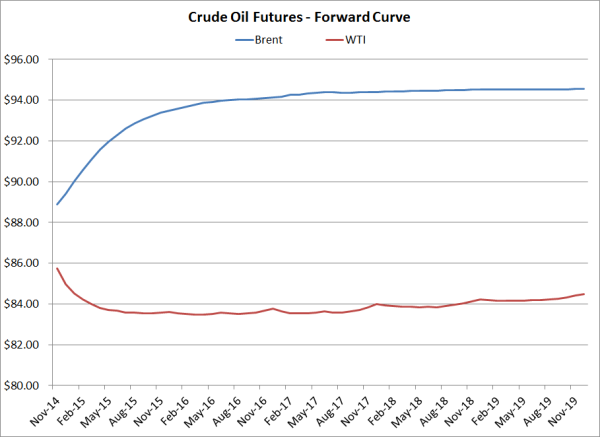

So what is market consensus regarding Brent and WTI prices in the coming months and years? Based on closing prices today, as shown on the following chart, Brent prices should retreat towards $95/BBL in early 2016 and remain relatively flat for several years. On the WTI side, the forward curve is suggesting that prices will weaken further in the coming months before beginning a long, slow increase, but still lower than current prompt futures.

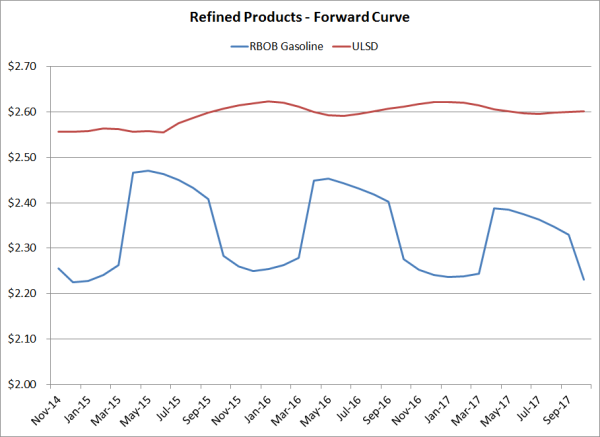

Taking a look at refined products, excluding seasonal peaks and valleys, the foward curve for both RBOB gasoline and ULSD futures indicates that the market consensus is for sustained, relatively low prices as well.

Back to the original question, have crude oil prices reached a bottom or are they close to doing so? The data as well as forecasts for most reputable analysts are calling for prices to continue to trade at relatively lower levels in the coming months unless we see evidence of one or more of the following:

- OPEC cuts production in a meaningful way

- Drilling and producing in US shale plays (i.e. Bakken) becomes uneconomic

- A geopolitical event(s) significantly decreases global production

- Economic growth increases enough to improve oil demand